Introduction

Medicare Part A and Part B are two components of the United States authorities's healthcare application for people elderly sixty five and older, in addition to for some more youthful individuals with particular disabilities or clinical situations. These elements, frequently called "Original Medicare," offer insurance for one of a kind components of healthcare services. In this specific weblog put up, we can discover Medicare Part A and Part B, their insurance, prices, eligibility standards, and enrollment manner.

Medicare Part A: Hospital Insurance

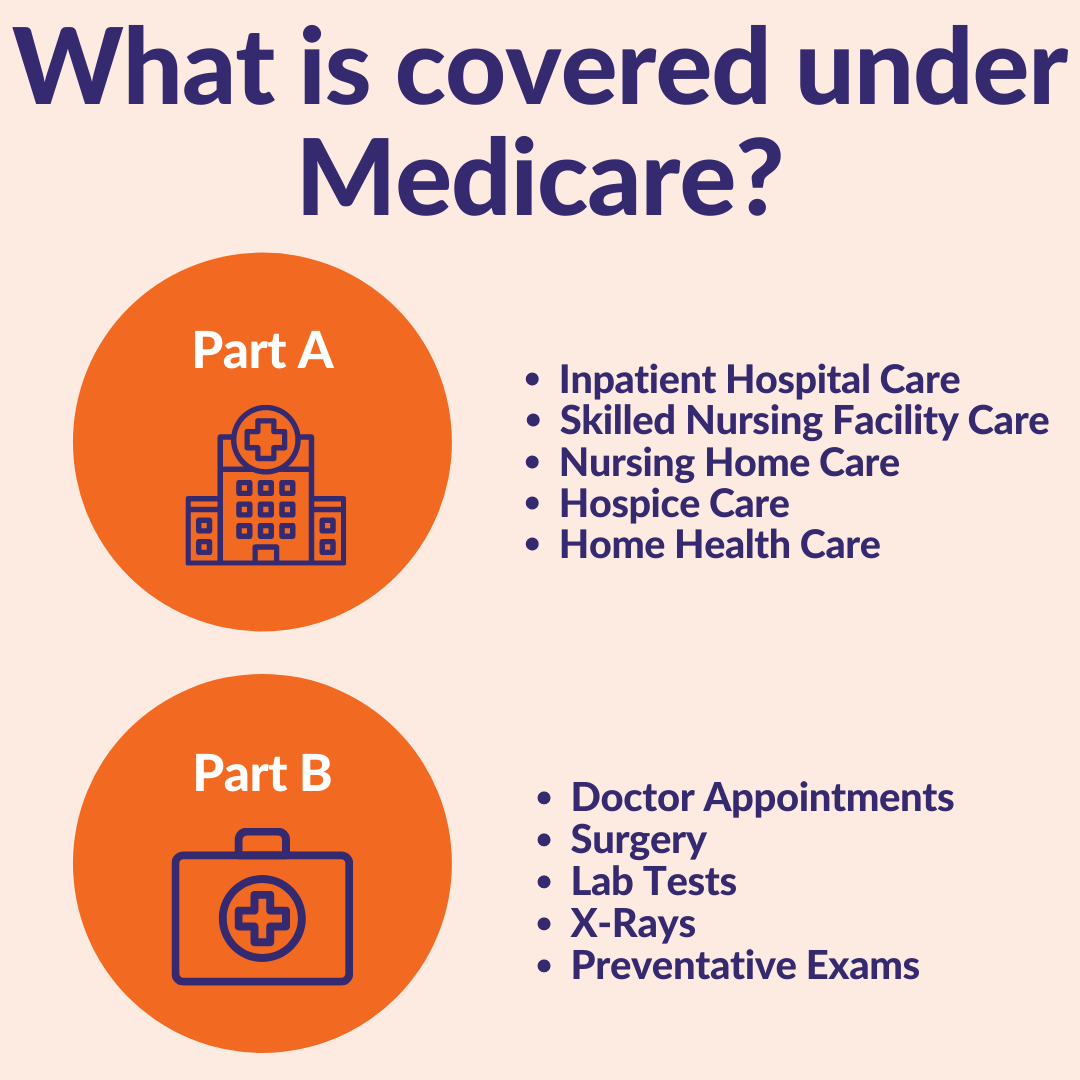

Medicare Part A broadly speaking covers inpatient health facility care and related services. It enables pay for the expenses related to health center stays, skilled nursing centers, hospice care, and some home health services. Here's a breakdown of the key components of Medicare Part A:

Inpatient Hospital Care: Part A covers costs associated with clinic remains, which includes room and board, nursing care, and necessary resources and medicines.

Skilled Nursing Facility Care: If you require skilled nursing care following a health center live, Medicare Part A covers a portion of the costs for as much as a hundred days per benefit length.

Hospice Care: Part A presents insurance for hospice care offerings for people with terminal illnesses. This consists of palliative care, ache comfort, and emotional guide for each the patient and their own family.

Home Health Services: Limited domestic fitness services are protected underneath Part A, along with skilled nursing care and remedy offerings whilst they're medically vital.

Blood Transfusions: Part A enables cowl the value of blood transfusions received during a covered inpatient health facility live.

Premium-Free for Most Beneficiaries: Many humans do not pay a top class for Part A due to the fact they or their partner paid Medicare taxes at the same time as running. If you don't qualify for premium-unfastened Part A, you can still sign up, however you may ought to pay a monthly top rate.

Medicare Part B: Medical Insurance

Medicare Part B focuses on outpatient scientific services and preventive care. It covers a wide range of healthcare offerings and enables pay for physician's visits, outpatient care, and preventive screenings. Here's what you want to recognise about Medicare Part B:

Doctor's Visits: Part B covers visits to doctors and different healthcare vendors, together with professionals. It will pay for offerings including workplace visits, lab checks, and preventive screenings like mammograms and flu photographs.

Outpatient Services: This includes offerings like outpatient surgeries, durable medical gadget (consisting of wheelchairs or oxygen), and ambulance transportation whilst deemed medically vital.

Preventive Care: Part B encourages preventive care by means of masking various screenings and services which could come across and prevent diseases early, consisting of diabetes screenings and cardiovascular screenings.

Mental Health Services: Coverage consists of outpatient mental health services, like remedy and counseling.

Medical Supplies: Certain medically important substances, like insulin and a few vaccines, are included below Part B.

Monthly Premium: Unlike Part A, Part B usually requires a monthly top class. The quantity of the premium can vary based in your earnings, however most humans pay the standard top rate.

Eligibility and Enrollment

To be eligible for Medicare, you generally need to be a U.S. Citizen or a prison everlasting resident who has lived inside the United States for at the least 5 non-stop years and meet one of the following criteria:

Age: You are sixty five years or older.

Disability: You have obtained Social Security Disability Insurance (SSDI) advantages for at least 24 months.

Enrollment in Medicare is commonly automatic in case you're receiving Social Security benefits whilst you turn 65 or after receiving SSDI blessings for 24 months. If you're no longer robotically enrolled, you could sign on for Medicare all through specific enrollment durations, together with the Initial Enrollment Period (IEP) and the General Enrollment Period (GEP).

In end, Medicare Part A and Part B are essential components of the U.S. Healthcare device, imparting coverage for inpatient and outpatient medical offerings, respectively. Understanding their insurance, prices, eligibility criteria, and enrollment approaches is crucial for people drawing close Medicare eligibility or the ones searching for to make knowledgeable healthcare decisions. To get customized facts and steerage, it is advocated to touch the Social Security Administration or Medicare directly or seek advice from a licensed coverage agent who specializes in Medicare plans.

Medicare Part A Premiums:

Medicare Part A, often referred to as "clinic insurance," covers inpatient health facility care, skilled nursing facility care, hospice care, and a few home healthcare services. Most human beings do now not must pay a top rate for Medicare Part A due to the fact they or their partner have paid Medicare taxes while operating for a certain period. This is frequently called having "top class-free" Part A.

To be eligible for top class-free Medicare Part A, you or your spouse need to have labored and paid Medicare taxes for at the least 40 quarters, that's equal to 10 years. If you do not meet this requirement, you could still be eligible for Part A, however you may ought to pay a premium.

For folks who do ought to pay a top rate for Medicare Part A, the fee can vary relying on how long you or your partner labored and paid Medicare taxes. In 2021, if you had to buy Part A, the monthly premium will be as high as $471.

Medicare Part B Premiums:

Medicare Part B, regularly referred to as "medical insurance," covers physician visits, outpatient care, preventive offerings, and durable medical gadget. Unlike Part A, most beneficiaries are required to pay a monthly top rate for Part B, no matter their paintings history.

The standard month-to-month premium for Medicare Part B is normally set with the aid of the government and may exchange yearly. The quantity you pay for Part B premiums also can depend on your profits. The government makes use of a sliding scale based for your changed adjusted gross profits (MAGI) from years previous to decide your Part B top rate. In 2021, the standard monthly top rate for Part B changed into $148.50, but it can be better if your income handed positive thresholds.

Late Enrollment Penalties:

It's critical to notice that if you put off enrolling in Medicare Part B while you are first eligible and do not have other creditable fitness insurance (which include through an corporation), you could incur a past due enrollment penalty. This penalty can bring about a higher top class for Part B for as long as you have the coverage.

Conclusion:

Understanding the charges related to Medicare Part A and Part B is essential for making plans your healthcare fees at some point of retirement. While Part A is regularly premium-unfastened for those with sufficient paintings records, most beneficiaries pays a month-to-month premium for Part B. It's important to hold track of Medicare enrollment intervals and be aware of any overdue enrollment consequences that could observe. By staying knowledgeable, you can make knowledgeable selections approximately your healthcare insurance and finances hence at some stage in your retirement years

Comments

Post a Comment